As the 29th annual UN Climate Change Conference (COP29) draws to a close this week in Baku, Azerbaijan, the world watches with bated breath, eager to see if leaders can rise to the challenge of addressing the climate crisis. The two-week summit has been a whirlwind of negotiations, debates, and critical decisions. Among the key questions: Will countries commit to more ambitious emissions reduction targets? Can nations agree on a new climate finance target to replace the existing $100 billion pledge set in 2009? And, perhaps, most importantly, how will the recent political shifts in the United States, particularly in the wake of the results of its 2024 Presidential Election, impact global climate action?

COP29 as an Opportunity to Advance Climate Finance

This COP summit is a defining moment in global climate governance as leaders are expected to establish a New Collective Quantified Goal (NCQG) on climate finance to replace the 2009 target. The NCQG is a collectively negotiated climate financing amount provided by developed to developing nations to aid their transition to a low-carbon future. These funds—often presented as loans, grants, or public-private partnerships—are intended to support climate adaptation and mitigation efforts. At present, economists estimate that emerging markets and developing countries excluding China will need about $2.4 trillion a year by 2030 to meet climate goals.

For many in the developing world, climate finance and climate justice are interlinked concepts. The disproportionate impact of climate change on poorer nations stems from a legacy of inequity. Historically, developed countries have not only been the primary contributors to greenhouse gas emissions but also amassed immense wealth by extracting valuable natural resources—such as coal, minerals, and more—from the Global South during colonial and industrial eras. These resources fueled and financed their industrial revolutions, often at the expense of the economic and ecological stability of the regions they exploited. Closing the climate funding gap is not only necessary for emissions reduction but also critical to building equitable solutions for the future.

Uncertain U.S. Climate Leadership Amid Political Shifts

While discussions at COP29 underscore the importance of global climate finance and a shared commitment to climate action, one notable absence looms: U.S. President Joe Biden. His absence at the summit, especially in light of Donald Trump’s recent election victory, casts a shadow over the future of U.S. climate leadership. Mr. Trump’s recent remarks at a Detroit, MI, campaign rally where he said, “We will frack, frack, frack, and drill, baby, drill” has climate advocates and international observers worried that the United States is not committed to long-term climate action at home or abroad. Particularly since world leaders, at COP28 in Dubai last year, agreed to transition away from fossil fuels, a stark but welcome departure from their previous stance of solely calling for restrictions.

Many view Mr. Trump’s rhetoric and recent cabinet picks—for instance, his Energy Secretary pick, Chris Wright, CEO of the oil and natural gas fracking services company, Liberty Energy, has said, “There is no climate crisis, and we’re not in the midst of an energy transition either”—as emblematic shifts away from the progress achieved under the Biden administration. Despite these concerns, there is reason to believe that the U.S. clean energy transition is too far advanced to reverse.

While one might view these as naïve musings rooted in blind hope for a better future, these perspectives are far from mere idealistic delusion. They are bolstered by a diverse range of stakeholders, including Democratic and Republican lawmakers, as well as powerful oil and gas lobbies who recognize the economic potential of the clean energy transition. This growing coalition of unlikely partners offers hope that the clean energy transition is a goal capable of weathering the storms of political change.

John Podesta, Senior Advisor to the President for International Climate Policy, and the US climate envoy to COP29, underscored this point, stating, “While the United States federal government under Donald Trump may put climate action on the back burner, the work to contain climate change is going to continue in the United States with commitment and passion and belief.”

“The historic investments under President Biden and Vice President Harris have crucially been government-enabled but private-sector led. In total, just since the President took office, companies have announced more than $450 billion in new clean energy investments,” Podesta continued. The ‘historic investments’ Podesta is referring to are a product of the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) (more commonly referred to as the Bipartisan Infrastructure Law or BIL). Although their names might not reflect it, the IRA and BIL are historic pieces of climate legislation. The BIL authorizes $1.2 trillion for transportation and infrastructure spending, with historic allocations for clean energy and grid modernization projects, electric vehicle infrastructure, and other climate resilience projects.

It is not surprising that Mr. Trump has not targeted the BIL for repeal, given that the law was a product of bipartisan collaboration. Instead, his focus has been on repealing the IRA, which passed without any Republican votes and included a broader range of climate-related financial incentives. In particular, Mr. Trump has said, “To further defeat inflation, my plan will terminate the Green New Deal, which I call the Green New Scam.” He added, “It actually sets us back, as opposed to moves us forward. And [I will] rescind all unspent funds under the misnamed Inflation Reduction Act.” Although Mr. Trump has expressed intentions to dismantle the IRA, there is a growing sense that a full repeal may be unlikely as many in his party and the business community recognize the economic opportunities the IRA presents.

The Inflation Reduction Act: Transformative Climate Legislation

This raises several questions: what exactly is the IRA, and how has it managed to gain such widespread support, even from sectors that traditionally align with Republican interests? More importantly, is Mr. Trump’s criticism of the IRA warranted, or will his sweeping claims prove to be shortsighted as the act continues to deliver measurable benefits across the U.S. economy?

The Inflation Reduction Act (IRA) is a bill that was signed into law by President Biden in August of 2022. Although it includes federal spending dedicated to issues like lowering healthcare costs by allowing Medicare to negotiate drug prices and reforming the Internal Revenue Service (IRS) to prevent tax evasion by corporations, at its heart, the IRA is a transformative piece of climate legislation. The IRA appropriates almost $400 billion for clean energy deployment and climate justice initiatives—the largest investment of its kind in U.S. history—while aiming to cut greenhouse gas emissions by 40% by 2030.

The IRA is revolutionary in its approach as it encourages climate action at all levels by engaging individuals, communities, businesses, and the federal government, alike. The IRA leverages rebates and tax credits to incentivize the adoption of green technology. These measures cover a wide range of initiatives, from promoting energy efficiency upgrades and increasing electric vehicle adoption to supporting the development and use of sustainable aviation fuel.

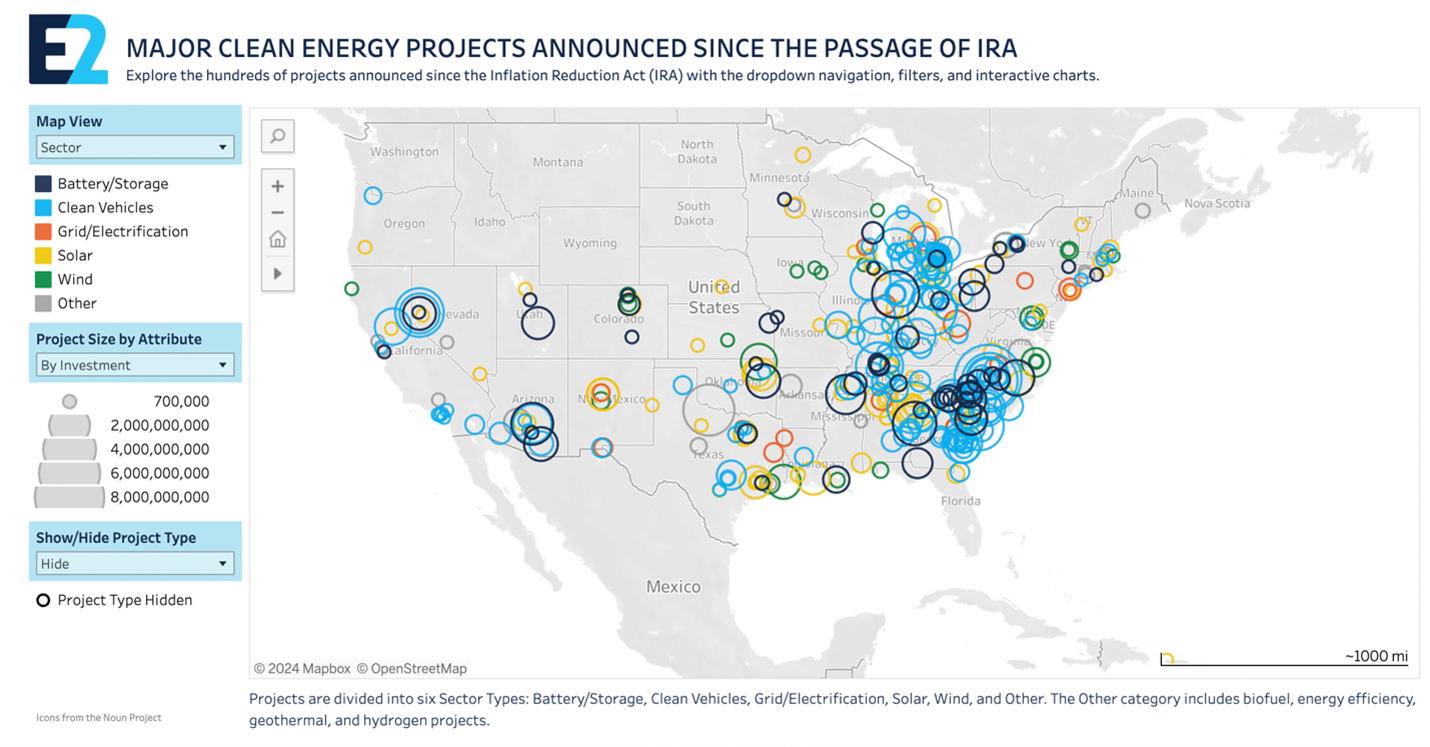

In the two years since the IRA’s passage, there have been 354 new clean economy projects announced in 40 states, attracting over $130 billion in investment and creating over 113,000 new jobs. What’s particularly notable is that, despite unanimous Republican opposition in Congress to the IRA’s passage, the benefits are disproportionately flowing to Republican states and congressional districts. Approximately 60% of IRA-related clean economy projects—representing 85% of announced private-sector investments and 68% of all jobs—are being directed to these areas. Specifically, if the announced projects are completed, Republican Congressional Districts will see 215 new clean energy projects, bringing in over $107 billion in investment and creating 79,200 new jobs. According to an analysis by E2, more than 110 major clean energy and clean vehicle manufacturing projects are under development or already underway in the Southeastern U.S., including 62 in South Carolina and Georgia.

E2’s interactive map highlights clean energy projects announced since the IRA’s passage. Circle density represents the number of projects, circle size indicates investment scale, and circle color differentiates sectors. The map reveals significant clean energy investments in the Midwest and Southeast—regions that supported Mr. Trump in the 2024 election.

Understanding Support for the IRA

So, although no Republicans voted to pass the IRA, Republicans today are eager to see the economic benefits tied to the IRA remain in their states. Gutting the IRA would prove counterproductive as it risks undermining the substantial economic growth and job creation already underway. Cutting or eliminating these provisions would not only harm industries and communities that stand to benefit but also jeopardize billions of dollars of private sector investments that have been catalyzed by the legislation. In fact, the IRA’s success depends on a robust partnership between the public and private sectors, with every federal dollar attracting approximately 5-6 dollars in private investment.

Support for the IRA is coming from a variety of unexpected sources. The U.S. utility industry, led by groups like Edison International, is urging the incoming Trump administration and Republican Congress to preserve critical clean energy and electric vehicle tax credits from the IRA, emphasizing their importance in lowering consumer bills and supporting sector growth. Additionally, oil and gas leaders like Darren Woods, CEO of ExxonMobil, have praised the legislation for incentivizing clean energy investments without mandating specific technologies, allowing the market to innovate while still driving down carbon intensity. According to Woods, the IRA’s outcome-focused approach is a model for future climate policy.

Back at COP29, Representative August Pfluger (R-Texas), who is leading the House of Representatives’ delegation to the UN climate summit, expressed support for aspects of the IRA, stating, “If there are pieces of the IRA that help support lowering American energy costs, helping Americans, helping our partners and allies have access to affordable, reliable energy, then I bet that those will stay in place.” This reflects a growing realization that certain elements of the IRA are now crucial to both economic and political stability, especially in energy-dependent Republican states.

Bridging the Global Climate Finance Gap: Lessons from the IRA

The global financing gap for emerging markets and developing countries remains a significant barrier to achieving climate goals. The establishment of the NCQG at COP29 is crucial for securing the necessary funding, and there will likely be increased pressure on the European Union to step up efforts to support developing countries. That said, the success of the IRA’s approach—leveraging public funding to catalyze private investment—offers valuable lessons for the global climate finance discussions. The IRA’s model of using targeted government incentives to unlock private capital could serve as a template for international climate finance. Just as the IRA has mobilized $5-6 in private investment for every federal dollar spent, similar multiplier effects could help bridge the $2.4 trillion annual funding gap faced by developing nations. This makes understanding the IRA’s structure and impact particularly relevant to current international climate negotiations.

As discussions at COP29 highlight the importance of global collaboration, it is important to remember that while the U.S. plays a critical role in driving global climate action, it is not the only player. Despite Mr. Trump’s previous withdrawal from the Paris Climate Accord during his first term and his renewed commitment to do so upon his return to office, the U.S. could still make significant strides toward its climate goals. The legacy of the Inflation Reduction Act and the Bipartisan Infrastructure Law may provide the stabilizing force needed to keep the country on track. These groundbreaking pieces of legislation represent not only a bold climate policy but also a deep investment in clean energy and infrastructure that could outlast any political shifts. The IRA’s success in leveraging public funding to unlock private investment serves as a valuable model that could inspire similar approaches to climate finance on a global scale, signaling that the clean energy transition is too strong a force to be easily derailed.